Cashback is an anglicism that translates to “money back” and is a widely used financial method to create savings for consumers. There are two types of cashback. The first is financial, when an amount is requested in cash at an establishment that has the service and when paying by card, the requested amount will be delivered in cash.

The second is cashback rewards, which is a method used by the web, specialized applications and banking entities that return part of the purchased goods to be used in future purchases of products.

Diego Palencia, Vice President of Research and Strategy at Solidus Capital Investment Banking, assured that “cashback systems are used in low-value payment systems to encourage the use of digital channels. Rewards have been implemented for users who use it with points recognition or cash back when making transactions.”

Wilson Triana, a banking and insurance expert, said these are tactics of the financial system and big business (companies like Jumbo and Carulla) to build customer loyalty and retention.

Cashback application

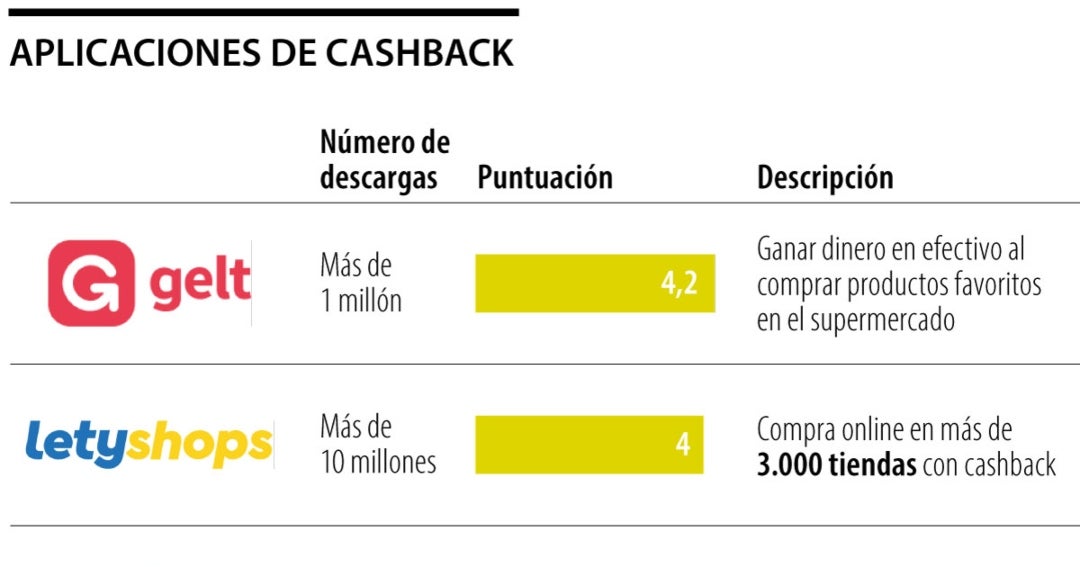

You can find several in the app stores that use this mechanism. Many options vary depending on the score and number of downloads. It is necessary to take into account what the application will be used for and whether the services it offers are in line with the needs of the users.

First up is LetyShops, an app that has over 10 million downloads and a 4.0 community rating. It is a shopping website and app. Some of the companies that are connected to LetyShops are AliExpress, Booking and Dafiti. Its use takes place in three steps: choose one of 3,190 stores, make a purchase and get part of the money invested for future purchases in stores.

With over 10 million downloads and a 3.0 rating, TuCash is an app that offers “bill payment that has the ability cashback“.

Companies like Eterna, Nestlé and LG are part of TuCash. Its operation consists in registering invoices from affiliated business establishments in order to receive a fraction of the purchase.

Triana explained that apps are channels that are used to drive sales and reach brands. In addition to applications, there are financial entities and insurance companies that implement the modality to increase the efficiency of processes.

“Apps like TuCash allow shoppers and businesses in general to transact with the benefits of points, miles or cash back for performing an operation in this digital ecosystem,” Palencia said. The expert states that although this modality has gained ground in national businesses, less than 15% of transactions are made through cashback. “A lot of people don’t know the benefits of such transactions,” he said.

Another app to consider is Rakuten, which aims to offer this modality through more than 3,500 stores. Refunds are made via check or PayPal.

In the app store, you can download other companies like Gelt (score 4.2); Mega Bonus (3.5); and Méliuz (4).

“The process is possible due to the reduction of cash management costs, acquisition commissions, servicing and above all due to the fact that there are specialized APIs that allow clearing and settlement of transactions in one operation. With a sophisticated checkout, businesses can provide cashback,” Palencia said.

It is important to note that some credit cards on the market also manage the cash back system.